Best Home Equity Loans: Compare Rates and Benefits

Best Home Equity Loans: Compare Rates and Benefits

Blog Article

Maximize Your Possessions With a Strategic Home Equity Lending Plan

One such opportunity that has amassed interest is the usage of home equity with a thoughtfully crafted lending strategy. As we navigate the intricate landscape of home equity financings, the value of careful preparation and foresight becomes progressively apparent.

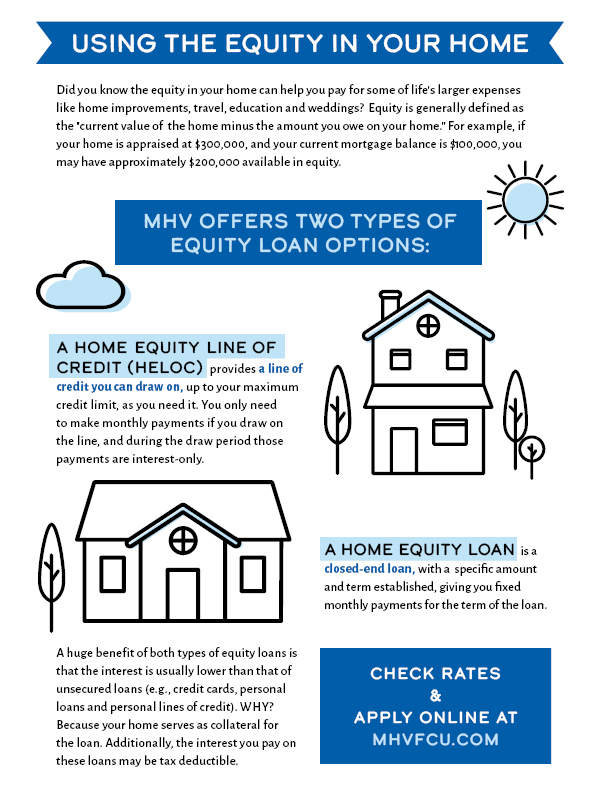

Understanding Home Equity Finances

A thorough grasp of the complexities surrounding home equity loans is essential for informed monetary decision-making. Home equity lendings permit property owners to utilize the equity accumulated in their residential property to accessibility funds for various purposes. One crucial aspect to comprehend is that these loans are protected by the worth of the home itself, making them less dangerous for lending institutions and typically resulting in lower interest rates for customers compared to unprotected car loans.

Moreover, understanding the loan-to-value proportion, payment terms, potential tax obligation implications, and the threats included in using your home as security are essential elements of making sound economic decisions relating to home equity loans. By acquiring a complete understanding of these aspects, house owners can utilize home equity finances strategically to accomplish their monetary goals.

Benefits of Leveraging Home Equity

Making use of the equity in your home can give a series of financial benefits when strategically leveraged. One of the key advantages of leveraging home equity is access to huge amounts of cash at fairly reduced rates of interest contrasted to other types of borrowing. By utilizing your home as security, lending institutions are extra happy to supply positive terms, making home equity car loans an appealing choice for financing major expenditures such as home restorations, education and learning prices, or financial debt combination

Furthermore, the interest paid on home equity lendings is typically tax-deductible, giving possible financial savings for house owners. This tax obligation benefit can make leveraging home equity even extra cost-efficient compared to various other kinds of loans. Additionally, home equity lendings commonly use much longer settlement terms than individual fundings or credit rating cards, enabling even more convenient monthly settlements.

Furthermore, by reinvesting borrowed funds into home renovations, homeowners can potentially enhance the value of their residential or commercial property. This can result in a greater resale worth or enhanced living conditions, additionally improving the financial benefits of leveraging home equity. In general, leveraging home equity carefully can be a tactical monetary move with different benefits for house owners.

Strategic Planning for Lending Utilization

Having established the advantages of leveraging home equity, the following important action is purposefully preparing for the usage of the finance proceeds - Equity Loan. When taking into consideration just how to best make use of the funds from a home equity lending, it is necessary to have a clear plan in position to make best use of the advantages and make sure economic security

One tactical strategy is to use the loan earnings for home renovations that will raise the home's value. Renovations such as kitchen upgrades, bathroom remodels, or adding added space can not only boost your everyday living experience yet additionally improve the resale worth of your home.

Another prudent use of home equity car loan funds is to consolidate high-interest financial debt. By settling debt cards, individual car loans, or other financial debts with lower rate of interest earnings from a home equity finance, you can save cash on passion settlements and simplify your financial resources.

Lastly, spending in education or moneying a significant expenditure like a wedding event or clinical bills can likewise be tactical uses home equity loan funds. By thoroughly intending just how to allocate the proceeds, you can take advantage of your home equity to achieve your financial goals successfully.

Considerations and threats to Remember

Thinking about the prospective risks and aspects to take right into account is vital when pondering the use of a home equity financing. One of the key threats linked with a home equity finance is the possibility of defaulting on payments.

An additional factor to consider is the rising and falling nature of rates of interest (Home Equity Loans) (Alpine Credits Canada). Home equity car loans frequently feature variable rates of interest, meaning your monthly settlements might increase if passion rates climb. This possible rise must be factored right into your economic preparation to stay clear of any shocks down the line

Furthermore, be cautious of overborrowing. While it may be appealing to access a big sum of cash through a home equity financing, only obtain what you really need and can afford to repay. Cautious factor to consider and prudent economic management are key to effectively leveraging a home equity lending without falling into monetary troubles.

Tips for Successful Home Equity Loan Administration

When browsing the realm of home equity fundings, prudent economic administration is vital for enhancing the benefits and decreasing the associated threats. To successfully handle a home equity car loan, start by developing an in-depth budget that outlines your month-to-month earnings, expenses, and financing payment obligations. It is critical to focus on timely settlements to prevent penalties and keep a good credit history.

Consistently monitoring your home's worth and the equity you have actually developed can aid you make notified choices about leveraging your equity better or changing your repayment approach - Equity Loans. In addition, think about establishing up automated settlements to make sure that you never ever miss a due date, thus safeguarding your economic standing

An additional idea for effective home equity lending administration is to check out chances for re-financing if rates of interest drop dramatically or if your credit history boosts. Refinancing can possibly lower your month-to-month repayments or allow you to repay the car loan faster, conserving you cash in the long run. By complying with these methods and remaining positive in your financial preparation, you can efficiently handle your home equity loan and take advantage of this valuable monetary device.

Final Thought

To conclude, critical preparation is essential when making use of a home equity funding to make the most of properties. Comprehending the threats and benefits, along with thoroughly taking into consideration exactly how the funds will certainly be used, can assist make certain successful administration of the lending. next By leveraging home equity sensibly, people can maximize their possessions and achieve their financial goals.

Home equity finances allow house owners to utilize the equity built up in their building to gain access to funds for different purposes. By using your home as collateral, lending institutions are a lot more eager to supply desirable terms, making home equity finances an eye-catching choice for funding significant expenditures such as home remodellings, education and learning costs, or debt combination.

In addition, home equity car loans commonly use much longer repayment terms than personal loans or credit rating cards, enabling for even more convenient regular monthly repayments.

Cautious consideration and prudent monetary monitoring are crucial to effectively leveraging a home equity funding without falling into monetary problems.

To properly take care of a home equity lending, start by developing a thorough budget plan that describes your month-to-month earnings, expenses, and car loan settlement responsibilities.

Report this page